Consumers around the world are driving innovation in the food systems as demand for more sustainable food sources continues to rise. With the global population expected to reach 9.7 billion by 2050, the consumption of protein is likely to go up significantly. People in the developing countries of Asia and Africa will also start consuming more meat in the coming years due to an increase in disposable incomes.

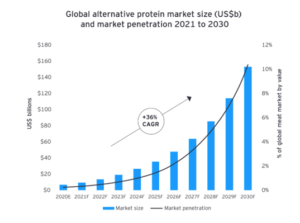

Revealing its estimates on the subject, EY (Ernst & Young) says that alternative protein penetration of the global meat market by volume will climb from <1% in 2020 to between 5% and 10% in 2030, and potentially much higher over the following decades.

According to the multinational professional services network, the cost of alternative protein production will likely fall below the cost of conventional protein production by the mid-2020s, and by 2030, the cost of alternative protein production is expected to be less than US$5 per kilogram. At the same time, the global average meat price will increase from approximately US$4.7 per kilogram in 2020 to more than US$5.2 per kilogram by 2030. This will have direct impact on global alternative protein consumption.

Today, over three-quarters of global agricultural land is used for livestock production, which only supplies one-fifth of the world’s calories. The current food production systems are also taking a toll on the planet, accounting for more than a quarter of global greenhouse gas emissions; more than half of which comes from livestock and fish production.

EY Food and Agriculture practice estimates the total alternative protein market will stand between US$77 billion and US$153 billion by 2030, up from between US$5 billion and US$10 billion in 2021. It also highlights that the conventional protein market is currently growing at about 2.4% per year, while alternative proteins are estimated to grow at more than 36% per year.

The study also talks about how the alternative protein segment comprising, plant-based, fermentation and cell-based products, will also make food chains more robust and resilient in periods of disruption. Manufacturers in alternative protein space will be able to alter their production more rapidly than conventional protein producers to meet rapid shifts in consumer demand or unexpected disruptions, such as those caused by pandemics.

It says that conventional producers should now start considering a more diversified portfolio to include alternative proteins since a consumer-led shift to alternative proteins in inevitable. While conventional animal production is not disappearing, new and potentially more profitable opportunities are emerging.

Alternative protein market is advancing rapidly and its disruption potential is growing. EY mentions the below recent disruptive market signals:

1) Major supply chains releasing and scaling alternative protein products

2) Cultivated protein startups acquiring other cultivated protein startups for key technologies

3) Regulatory approvals on novel ingredients, production processes and products, such as the approved sale of cultivated products in Singapore in November 2020

4) Cost reductions in cultivated production inputs such as scaffolding and growth media

5) Plant genetics startups focusing on ultra-high protein crops for use in plant-based consumer foods

6) Governments becoming increasingly invested in alternative protein research and funding, most recently in biomass and precision fermentation technologies

The company says that startups, crop growers, conventional protein producers, grain processors and retailers all can profitably capitalise on emerging, consumer-driven alternative protein trends.